You want to make sure your bike is protected with motorcycle insurance. learn in this post how much is motorcycle insurance. Hey, we’re also bikers! We understand. A motorcycle is more than just a mode of transportation. It is your pride and joy. It’s like having a lifelong friend. It’s the passion you share with your family and friends. Having a motorcycle is a great expression of freedom.

And you want to make sure your bike is protected with motorcycle insurance. Exactly. When something goes wrong, you want to have the best motorcycle insurance by your side, so that you can quickly file a claim and have the damage repaired. We at insurancereviews911.com have prepared an interesting post about motorcycle insurance.

Is motorcycle insurance required?

A motorcycle insurance policy is required by law in 48 states. Without proof of insurance, you can’t even register a motorcycle in those 48 states. Florida and New Hampshire are the only states which do not require motorcycle owners to carry liability insurance. For more details about motorcycle insurance requirements in your state, contact your local motorcycle dealer, insurance agent, or insurance company. You can also reach us by phone. We are happy to help.

How should I insure my motorcycle?

Apart from the coverage that is required in your state, it’s your choice of which coverage to take. Customizing your coverage allows you to protect what matters most to you as well as save money. Think about the way in which you use your motorcycle. Will you have a passenger onboard? Did you just purchase a new motorcycle? Would you say that you take a lot of long road trips? Make sure you select the right motorcycle insurance policy for your needs.

If my motorcycle is stolen, what happens?

In most cases, theft is covered as part of comprehensive coverage. Detailed information on what theft protection covers can be obtained by contacting your agent or insurance company. Remember that there are many things you can do to prevent motorcycle thefts and that there are many steps you can take.

Where can I find cheap motorcycle insurance?

There are many things you can do to reduce your motorcycle insurance costs. Make sure you do not commit traffic violations, such as speeding. Make sure you don’t skip payments or let your coverage lapse. The majority of insurance companies offer discounts if you have taken a motorcycle rider safety course, own multiple motorcycles, or are a member of a motorcycle group.

What is the cost of motorcycle insurance?

Motorcycle insurance is available for as low as $6 a month. Even so, there are many factors that influence the cost of motorcycle insurance, regardless of whether you a novice motorcycle rider or an expert. Some of these factors include where you live, how long you’ve been riding a motorcycle, and the type of coverage you’re looking for. All the information you need can be obtained from your agent or your insurance company.

Which types of motorcycles are insured?

No matter what type of motorcycle you ride – standard, cruiser, touring, sport touring, sports, trike, ATV, dual-purpose, scooter, or autocycle – we are able to insure almost all brands. Get a quote now.

- The majority of U.S. states require motorcycle insurance, but every rider benefits regardless of local requirements.

- A motorcycle rider may think about several things when he jumps on his bike – helmet, leathers, boots, gas, tires – but insurance coverage may not be among them.

- Insurance coverage is important.

- Your choice of insurance company will influence the cost of your motorcycle insurance. Every biker should compare rates before choosing a policy.

Rates of motorcycle insurance by state (2022)

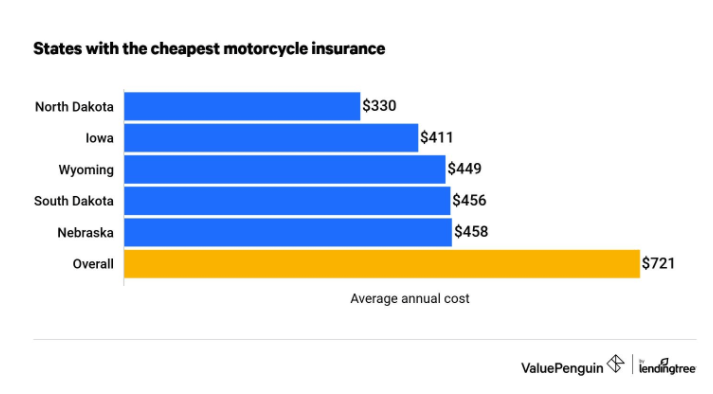

We reviewed all 50 states’ motorcycle insurance quotes and determined the average cost for a full year’s coverage is $721. It’s a good idea to get multiple quotes to get the best price since the price of coverage varies based on your location.

Below is a table showing how much motorcycle insurance costs in your state on average per month.

| State | Cost per month | Cost per year | Diff. vs. U.S avg. |

| California | $151 | $1,816 | 152% |

| Louisiana | $95 | $1,142 | 58% |

| Missouri | $85 | $1,016 | 41% |

| Michigan | $79 | $953 | 32% |

| Florida | $79 | $942 | 31% |

| North Carolina | $78 | $936 | 30% |

| Rhode Island | $76 | $915 | 27% |

| Kentucky | $76 | $908 | 26% |

| Tennessee | $74 | $888 | 23% |

| Massechusets | $72 | $866 | 20% |

| Utah | $69 | $832 | 15% |

| Texas | $69 | $822 | 14% |

| Mississippi | $68 | $813 | 13% |

| Montana | $68 | $813 | 13% |

| Oregon | $67 | $809 | 12% |

| Delaware | $66 | $797 | 11% |

| Arkansas | $65 | $778 | 8% |

| Georgia | $65 | $776 | 8% |

| Oklahoma | $64 | $767 | 6% |

| Arizona | $64 | $765 | 6% |

| Illinois | $62 | $739 | 3% |

| South Carolina | $61 | $737 | 2% |

| Washington | $61 | $733 | 2% |

| Nevada | $60 | $721 | 0% |

| Alabama | $60 | $716 | -1% |

| Maryland | $59 | $711 | -1% |

| New York | $59 | $705 | -2% |

| Virginia | $57 | $684 | -5% |

| Pennsylvania | $56 | $672 | -7% |

| Connecticut | $55 | $658 | -9% |

| New Jersey | $54 | $653 | -9% |

| New Mexico | $54 | $650 | -10% |

| Idaho | $54 | $649 | -10% |

| New Hampshire | $53 | $636 | -12% |

| Ohio | $52 | $620 | -14% |

| Colorado | $52 | $619 | -14% |

| West Virginia | $49 | $583 | -19% |

| Indiana | $48 | $577 | -20% |

| Hawaii | $46 | $550 | -24% |

| Kansas | $44 | $533 | -26% |

| Minnesota | $44 | $530 | -26% |

| Maine | $41 | $486 | -33% |

| Vermont | $40 | $483 | -33% |

| Wisconsin | $40 | $479 | -34% |

| Alaska | $40 | $477 | -34% |

| Nebraska | $38 | $458 | -36% |

| South Dakota | $38 | $456 | -37% |

| Wyoming | $37 | $449 | -38% |

| Iowa | $34 | $411 | -43% |

| North Dakota | $28 | $330 | -54% |

The states with the cheapest motorcycle insurance

Each of the five states with the cheapest motorcycle insurance quotes had rates that were at least 36% lower than the national average. Midwest and Great Plains states had the lowest rates.

What are the factors that affect the price of motorcycle insurance?

As part of your coverage, you’ll need to provide full details about your bike and how you ride. You will have to tell your insurer where you ride and how far you ride, if you have other riders, the value of your bike, and where you park it.

Almost all motorcycle insurance policies include a “lay-up credit,” which allows you to pause coverage for part of the year. The majority of riders take advantage of this during the winter when they store or store their bikes in the garage. You may be able to establish longevity and trust with one insurance company by establishing a lay-up credit, and it may lower your rate in the long run.

Different states have different rate-setting requirements, but here are some of the factors that can affect a premium:

- The location

- Age and previous riding experience

- How often do you ride

- Speeding and traffic tickets

- Accident and claim history

- Type of bike

- Your credit rating

- Coverage selection

- Amount of deductible

Is motorcycle insurance cheaper than auto insurance?

In general, motorcycle insurance is cheaper than auto insurance. A typical car policy costs $1,674 per year, while a motorcycle policy costs $519 per year, according to J.D. Power data. However, the cost of motorcycle insurance depends on a number of factors, such as the value of your bike, your driving history, and where you live.

Is it possible to bundle motorcycle and auto insurance?

In most cases, you can bundle your auto and motorcycle insurance as long as your provider offers them both. Combining your auto and motorcycle insurance can save you money. A majority of insurance companies encourage you to insure multiple vehicles with the same company at the same time. If you bundle policies, you’ll often get a discount of 5% to 20%.

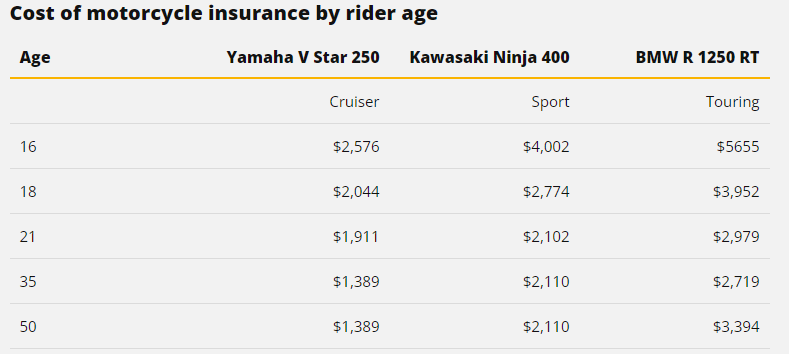

What is the effect of age on motorcycle insurance rates?

Generally, motorcycle insurance companies charge higher premiums to young drivers since they are viewed as more likely to be involved in an accident.

As well as the city you live in, the amount of coverage you buy, and your driving history, motorcycle insurance companies calculate the cost of your policy based on your age and the number of years you’ve been riding.

Motorcycle insurance costs by age.

conclusion

Motorcyclists need insurance; it’s illegal to ride without it. But there’s no good reason to pay too much for motorcycle insurance. Having your policy auto-renew is often the easiest way to overpay. When it comes to insurance, loyalty is often not rewarded.

Compare insurance quotes from a few different companies to prevent paying more than you need for the same level of coverage.

Finding cheap motorcycle insurance quotes is easy with a quick and simple price comparison. Simply enter a few details about you and your motorcycle, scooter, or moped, and we will give you instant access to 20 of the leading motorcycle insurance companies.