Gap insurance pays the difference between the value of your vehicle and what you still owe on it. It is typically used when your vehicle is stolen or totaled. The comprehensive or collision coverage of your car insurance pays out the actual cash value (ACV) of your vehicle, less the deductible. The gap insurance may then pay the difference between the vehicle’s ACV and your loan balance.how do i know if i have gap insurance

What is gap insurance?

As soon as you drive a new car off the lot, its value starts to depreciate. If you total your new car within the first few years, you could owe more to the bank than it is worth. Guaranteed asset protection, or “gap” insurance, covers this difference. see mor in google

The gap insurance policy comes into play when you make a total loss claim on your financed vehicle – either after the vehicle is totaled (the cost of repairs would be more than the car is worth) or if the vehicle is stolen. A total loss claim will be paid up to the actual cash value (ACV) of your car.

Occasionally, the amount you owe in car payments exceeds the car’s ACV. You can pay off your loan with gap insurance, sometimes called loan/lease payoff insurance. Remember, even if your car is totaled, your loan remains.

What is the cost of gap insurance?

Gap insurance is usually inexpensive, but its cost can vary. A gap insurance policy from the dealership can cost hundreds of dollars a year. When you add gap coverage to an insurance policy that includes collision and comprehensive coverage, your premium typically increases by about $40 to $60 per year.

Gap insurance: how is it calculated?

Generally, lenders and dealers determine how much gap insurance you need based on your loan and the depreciation of your vehicle. For larger loans, gap insurance can be more expensive. Insurance companies calculate your gap insurance cost based on your vehicle and driving history.

Gap insurance always pays out?

You can only receive a gap policy if you file a total loss claim for your vehicle and your loan settlement does not cover the remaining balance of your loan. If another driver was at fault, gap insurance can cover the difference between the insurance company’s settlement offer and the outstanding loan

Gap insurance: how does it work?

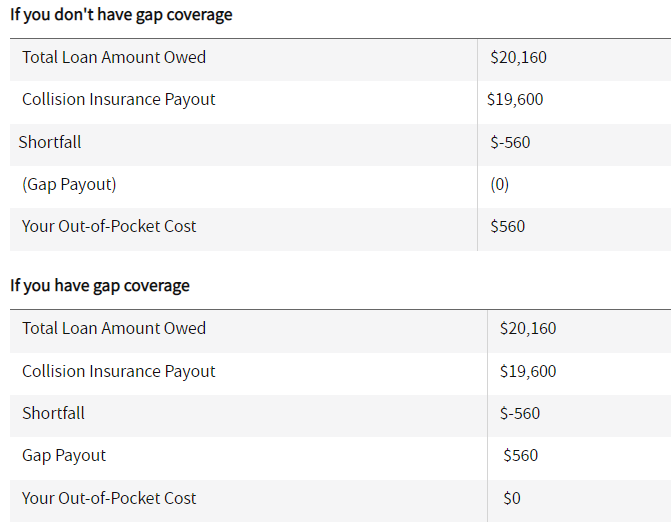

As soon as you buy your car, its value decreases, sometimes dramatically. In the case of financing or leasing a vehicle, this depreciation leaves a gap between what you owe and what the car is worth. Consider the following scenario:

EXAMPLE:

You finance a new car for $30,000. Having owned it for a few years, you’ve made all your payments on time. It’s now worth $20,000, but you still owe $25,000 on the loan, resulting in a $5,000 gap. When a vehicle is totaled, your insurer will pay you $25,000 (less your deductible). Your total payout would be $20,000 without gap insurance (minus your deductible).

Do You Need Gap Insurance?

You may have heard the term “upside-down” in reference to your home mortgage debt. The situation isn’t as bad as it seems.

What are the types of GAP insurance?

If you don’t know what you will need, don’t rush into agreeing a policy. It is not possible to have more than one GAP policy on one vehicle, but some suppliers offer “combined” coverage, giving you better coverage and the security you need.

- Finance GAP Insurance: Often offered as part of a package with other types of coverage, this is one of the simplest policies on the market. Designed to cover the outstanding finance payments of a written-off vehicle, it generally does not cover payments concerning negative equity.

- Negative Equity GAP Insurance: Compared to the Finance Gap Insurance, this policy will cover those whose loan amount is greater than the cost of their car.

- Return to Invoice GAP Insurance:

- This policy, also known as Back to Invoice, bridges the gap between your car insurance payout – which fluctuates based on the current value of the car at the time of the claim – and the amount you paid for the vehicle, preventing you from being severely out of pocket.

- Vehicle Replacement GAP Insurance: The purpose of this policy is to cover the difference between the payout from your car insurance policy and the cost of replacing your car with a new one (if it was brand new originally). This is a good purchase for those who received a discount or contribution from their dealer when purchasing their car, and are concerned that after a write-off, they will not receive the same level of discount.

insurance with gap coverage

Understanding Insurance with Gap Coverage: Everything You Need to Know

In today’s dynamic world, insurance isn’t just about protection; it’s about ensuring complete peace of mind. Among various insurance types, one that often gets overlooked is gap insurance. If you’ve ever financed a car or made a significant purchase on credit, understanding insurance with gap coverage is crucial.

What is Gap Coverage?

Gap insurance, often referred to as ‘Guaranteed Auto Protection’, is a financial tool designed to cover the difference (or the ‘gap’) between the amount you owe on a loan and the asset’s actual value, especially if it gets totaled or stolen.

Why is Gap Coverage Important?

Imagine buying a brand-new car. As soon as it leaves the dealership, its value depreciates. If, unfortunately, your car gets totaled in an accident a few months later, the amount your primary insurance pays might only be the current market value of the car, which is now less than what you owe on your loan. This is where gap coverage comes into play, covering the difference and preventing you from paying out of pocket.

Key Features of Gap Coverage:

- Asset Protection: Primarily designed for new vehicles, ensuring that you aren’t left with hefty bills in the face of depreciation.

- Flexible Payment Options: Many providers offer varied payment methods, allowing for easier financial planning.

- Transferability: Some gap insurance policies are transferable, adding value if you decide to sell the asset.

- Affordability: Generally, the cost of gap coverage is a small addition to your monthly insurance premium.

Is Gap Coverage for Everyone?

While gap insurance provides essential protection for many, it isn’t for everyone. If you own your car outright or are nearing the end of your loan term, gap coverage might not be as beneficial. It’s primarily useful for:

- Those who’ve made a small down payment.

- People with long-term loans.

- Leaseholders.

- Anyone concerned about the depreciation of a newly acquired asset.

How to Buy Gap Insurance?

- From Your Current Insurer: Many auto insurance providers offer gap coverage as an add-on.

- Through Your Dealership: Some car dealers offer gap insurance during the purchase process.

- Dedicated Gap Insurance Providers: Specialized companies focus solely on providing gap coverage.

Final Thoughts

Gap coverage can be a lifesaver, especially when dealing with unforeseen circumstances that affect your valuable assets. However, always compare prices, read the fine print, and ensure it fits your financial situation. Stay protected, stay wise!

RECOMMENDED

how much does a nose job cost with insurance

can i insure a car not in my name?

what is twisting in insurance