Will Insurance Cover a Tummy Tuck? A Comprehensive Guide

Will insurance cover a tummy tuck?” is a question many individuals ponder when considering abdominoplasty, a surgical procedure designed to enhance the abdomen’s appearance. While tummy tucks can offer transformative results, understanding the financial implications and insurance coverage nuances is crucial before making a decision. This comprehensive guide delves into the intricacies of insurance coverage for tummy tucks, helping you navigate the process with clarity.

Introduction:

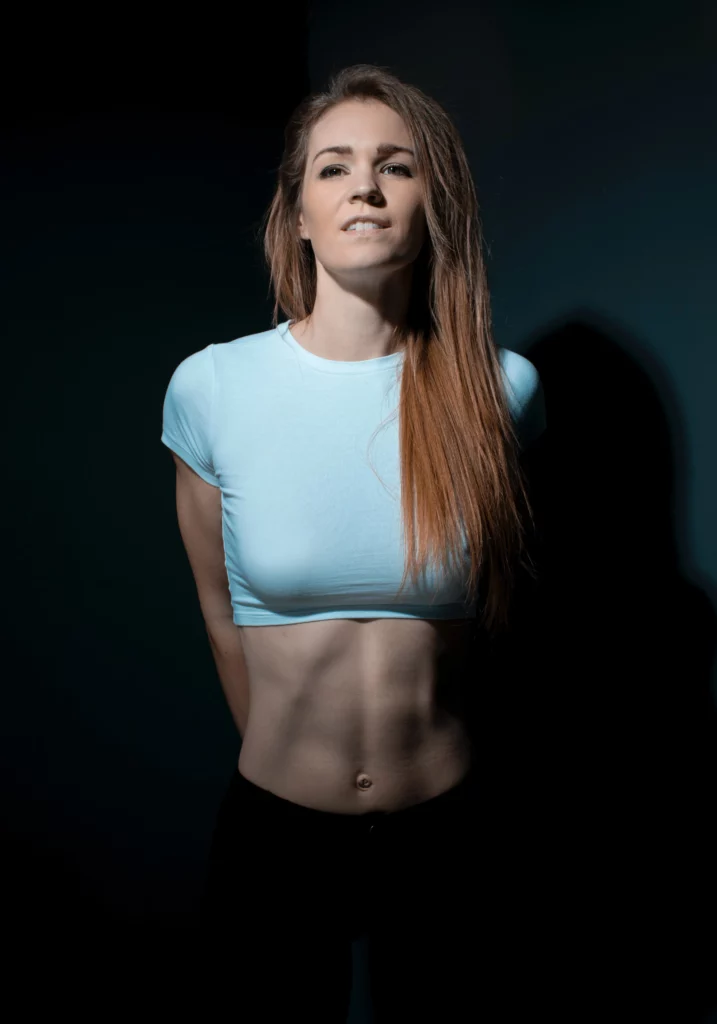

Abdominoplasty, commonly known as a tummy tuck, is a cosmetic surgery procedure designed to remove excess skin and fat from the abdomen, offering a more contoured appearance. While the benefits are clear, the potential costs can be a significant concern for many. The burning question for potential candidates is: Does insurance cover a tummy tuck? While most cosmetic procedures aren’t covered by insurance, certain medical conditions and circumstances might make an exception.

When Might Insurance Cover a Tummy Tuck?

Insurance might step in to cover a tummy tuck if it’s deemed medically necessary. This doesn’t mean enhancing one’s appearance but rather addressing a medical condition.

- Excess Skin and Fat: Conditions arising from excess skin and fat, such as chronic back pain, skin infections, or respiratory issues, might necessitate a tummy tuck.

- Hernias: In some cases, a severe hernia might require a tummy tuck as part of the treatment.

- Post Bariatric Surgery: Patients who’ve undergone weight loss surgeries like bariatric surgery might need a tummy tuck to address excess skin.

Navigating Insurance for a Tummy Tuck

To determine if your insurance might cover a tummy tuck:

- Contact Your Provider: The most straightforward approach is to directly ask your insurance provider about their policies related to abdominoplasty.

- Medical Documentation: If you have a medical condition that necessitates a tummy tuck, ensure you have all the required documentation from your healthcare provider.

- Pre-Approval: If the tummy tuck follows a medically necessary procedure, always get pre-approval from your insurance. This ensures that they cover the costs associated with the tummy tuck.

Maximizing Your Insurance Benefits

If your tummy tuck gets the green light from insurance, consider the following to maximize your benefits:

- In-Network Doctors: Opt for a surgeon within your insurance network to minimize out-of-pocket expenses.

- Organize Paperwork: Have all necessary documentation ready to expedite the insurance claim process.

- Keep Receipts: Track all related expenses and promptly submit them to your insurance provider.

Part 2: Delving Deeper into Insurance Coverage for Tummy Tucks

Factors Influencing Insurance Decisions

While the overarching principle is that insurance covers medically necessary procedures, the interpretation of “medically necessary” can vary. Here are some factors that might influence an insurance provider’s decision:

- Medical History: Insurance companies will look at your medical history. Chronic conditions exacerbated by excess abdominal skin and fat, like recurring infections or hernias, can strengthen your case.

- Previous Treatments: If you’ve tried other treatments without success, your insurance might be more inclined to cover a tummy tuck. For instance, if you’ve sought physical therapy for back pain without relief, a tummy tuck might be seen as a more definitive solution.

- Documentation: A well-documented recommendation from a primary care physician or specialist can make a difference. This might include details about why other treatments were ineffective and why a tummy tuck is the recommended solution.

State Regulations and Insurance Coverage

Insurance regulations can vary significantly from one state to another. Some states have mandates that require insurance companies to cover specific procedures, while others leave it to the discretion of the insurance provider. It’s crucial to understand your state’s stance on tummy tucks and insurance.

Alternative Financing Options

If your insurance doesn’t cover a tummy tuck, or if the out-of-pocket costs are still prohibitive, consider these alternatives:

- Payment Plans: Many medical facilities offer payment plans, allowing you to spread the cost over several months or even years.

- Medical Credit Cards: These are credit cards specifically designed for medical expenses. They often come with promotional periods offering 0% interest.

- Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs): If you have an HSA or FSA, you might be able to use these funds. However, ensure you understand the stipulations, as not all cosmetic procedures may qualify.

Preparing for the Procedure

If you’ve navigated the insurance maze and are moving forward with a tummy tuck:

- Consultations: Ensure you have thorough consultations with your surgeon. Understand the procedure, risks, benefits, and recovery time.

- Post-Procedure Care: Plan your post-procedure care. This might include arranging for help at home, especially in the initial days after the surgery.

- Understand the Limitations: A tummy tuck can offer significant improvements, but it’s essential to have realistic expectations.

Part 3: Beyond the Procedure – Recovery, Results, and Long-Term Considerations

Recovery from a Tummy Tuck

A tummy tuck is a significant surgical procedure, and understanding the recovery process is essential:

- Immediate Aftercare: After the surgery, you’ll likely have bandages and drainage tubes. It’s crucial to follow your surgeon’s instructions on caring for the surgical site and drains, taking prescribed medications, and more.

- Activity Restrictions: Expect to limit strenuous activities for several weeks. While light walking can aid recovery, activities like lifting, bending, and strenuous exercise will be off-limits initially.

- Pain Management: Some discomfort is expected after the procedure. Your doctor will prescribe pain medications, and it’s essential to take them as directed.

- Follow-Up Appointments: Regular check-ins with your surgeon are vital. They’ll monitor your healing, remove stitches, and address any concerns.

Ensuring the Best Results

While a tummy tuck can provide transformative results, ensuring they last is up to you:

- Maintain a Stable Weight: Significant weight fluctuations can affect your results. Aim for a stable weight to maintain the benefits of your tummy tuck.

- Healthy Lifestyle: A balanced diet and regular exercise can not only help maintain your tummy tuck results but also promote overall health.

- Avoid Smoking: Smoking can hinder the healing process and negatively impact your surgical results.

Long-Term Considerations

- Scarring: While your surgeon will aim to make incisions in less noticeable areas, scarring is inevitable. Over time, these scars will fade but may not disappear entirely.

- Future Pregnancies: If you’re considering future pregnancies, discuss this with your surgeon. Pregnancy can stretch the abdominal muscles and skin, potentially reversing some benefits of the tummy tuck.

- Aging: As with all cosmetic procedures, a tummy tuck doesn’t stop the natural aging process. Over time, skin may sag or become lax.

Conclusion:

The question, “Does insurance cover a tummy tuck?” isn’t straightforward. Coverage depends on various factors, including your insurance plan, medical necessity, and where you reside. Always consult with your insurance provider and medical professional to understand your options.

Navigating the world of insurance coverage for tummy tucks can be complex. While the procedure can offer transformative results, understanding the financial aspects is crucial. Whether through insurance, alternative financing, or out-of-pocket payments, ensure you’re making an informed decision.

“Does insurance cover a tummy tuck?” is a question many ask, and while the answer varies, understanding the intricacies of the procedure, recovery, and long-term results is crucial. A tummy tuck can offer a renewed sense of confidence and improved physical comfort. However, it’s a decision that should be made with thorough research and consideration. Always consult with medical professionals and your insurance provider to make the most informed choice.

For more insights on cosmetic procedures and insurance nuances, explore our extensive reviews and articles.

External Links:

- American Society of Plastic Surgeons: Tummy Tuck Recovery

- WebMD: What to Expect After a Tummy Tuck

- American Board of Cosmetic Surgery: Financing Your Procedure

- HealthCare.gov: Using your HSA or FSA

- American Society of Plastic Surgeons: Tummy Tuck

- Mayo Clinic: Tummy Tuck

- WebMD: Understanding the Tummy Tuck Procedure