How much is car insurance for 16 year old? Driver’s licenses are one of life’s most exciting milestones. It’s also important to consider your car insurance options to stay financially protected while on the road with your newfound freedom. The cost of adding a 16-year-old driver to a parents’ policy can increase by $2,531 per year for full coverage. The average cost of full coverage auto insurance for a married couple with a 16-year-old is $4,156 annually. It is likely the rate would be higher if parents decide to purchase a vehicle for their child to drive.

How can 16-year-old drivers save on their auto insurance?

What is the cost of auto insurance for a 16-year-old? 16-year-olds will generally pay higher auto insurance rates than older, more experienced drivers. To help teenagers manage their insurance costs, we have a few tips.

The first step teen drivers should take is to compare multiple auto insurance quotes. Select a company that offers the best rates without compromising the coverage you need.

You’ll likely want to stay on your parents’ policy for as long as possible if you want to get the best auto insurance rates for a 16-year-old. How long can you stay on your parents’ policy? You can stay on your parents’ policy for as long as you like, contrary to popular belief.

We will discuss these tips in greater detail in the upcoming sections, and even provide you with actual discounts offered by major companies. Continue reading. How much is car insurance for 16 year old

What Is the Cost of Car Insurance for a 16-Year-Old?

When insurance companies calculate the cost of 16-year-old car insurance, the risk is the most important factor. In other words, the higher the risk, the higher the premium. Teenagers have less experience driving than older drivers, so they are more likely to get into an accident or receive a moving violation. Young drivers pay higher premiums to protect themselves from this higher risk.

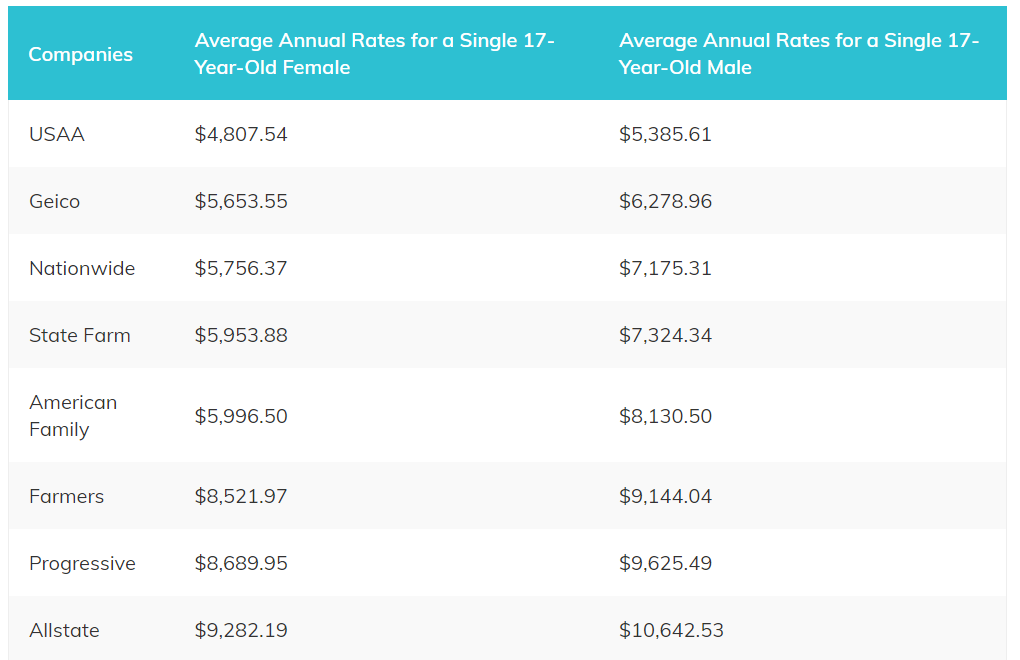

A recent survey showed that Nationwide offered the lowest rate when all other metrics and coverage were kept constant. When your teen gets older and circumstances change, it is important to shop around to find the best insurance rates.

Insurance premiums are affected by gender as well. A 16-year-old male driver is statistically more likely to receive a citation or get into an accident than a 16-year-old female driver. A 16-year-old male pays over $440 more per six-month period for insurance than a female.

How much does teen car insurance cost?

Insurance Institute for Highway Safety reports that teens get into accidents four times as often as drivers 20 and older. According to the Centers for Disease Control and Prevention, car accidents are the leading cause of death for teenagers in the U.S.

There are a variety of factors that influence the cost of insurance for teens, including the state in which the teenager lives, the teen’s gender and age, and whether the teen is the primary policyholder. A newly licensed 16-year-old driver can pay an average of 44% more for full coverage than a more experienced 19-year-old driver.

We found that the cost of car insurance for teens varies widely by state, but here are the average annual prices we found for full coverage and minimum coverage, by age:

- 16-year-olds: $6,613 for full coverage; $2,733 for minimum coverage.

- 17-year-olds: $5,373 for full coverage; $2,206 for minimum coverage.

- 18-year-olds: $4,837 for full coverage; $1,938 for minimum coverage.

- 19-year-olds: $3,716 for full coverage; $1,451 for minimum coverage.

In our analysis, full coverage policies include comprehensive, collision, uninsured/underinsured motorist protection, and increased liability limits. Minimum coverage policies include only state-mandated coverage.

RECOMMENDED

how much does a nose job cost with insurance