To get your nose job covered by your insurance, you’ll have to prove it’s needed to address functional issues that have not responded to more conservative treatments. A rhinoplasty may be deemed medically necessary, and therefore be covered by insurance if you have difficulty breathing because of:

-Are structural abnormalities

-caused by chronic nasal or sinus inflammation

-Misshapen cartilage

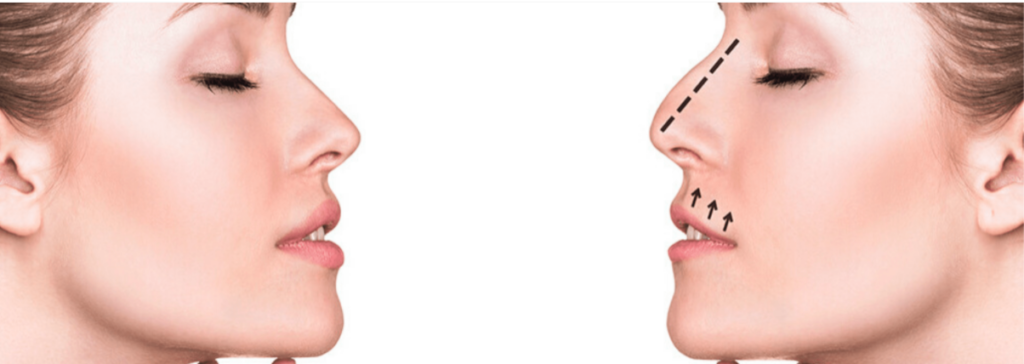

-It is common to combine functional and cosmetic rhinoplasty, altering both the interior passages and the exterior shape and contours. Cosmetic rhinoplasty can improve facial harmony by correcting:

-Narrow or wide nostrils

-Humps or depressions in the bridge

-Deformed nasal tip (for example, enlarged or hooked)

-Nasal asymmetry

The functional portion of rhinoplasty is usually not covered by insurance when combined with cosmetic rhinoplasty.

Health insurance covers rhinoplasty?

This post is probably being read because you are interested in contracting health care insurance and have doubts about the coverage of some medical services in the policy, for example, whether insurance covers a rhinoplasty. There are many reasons why someone wants a nose job, but the most serious is when you can’t breathe well or have respiratory problems, which require interventions like turbinate surgery or secondary rhinoplasty.

On the one hand, such operations are performed for aesthetic reasons, but they are also used to treat respiratory problems for different reasons. To solve these problems, there is this operation. At Sanitas Seguro Médico Center, we will explain to you what rhinoplasty is and what it involves.

What does it entail? Is health insurance covering a rhinoplasty?

In order to see whether medical insurance covers a rhinoplasty, let us explain a little more about this concept.

It is a nose operation that can be performed for a variety of purposes. That is, each operation of this type is dictated by the needs and concerns of the patient. But what are these purposes? Well, rhinoplasty can be used to remedy birth defects, nasal discomfort, congenital asymmetries, accidental deformities, respiratory problems, or simply for aesthetic purposes.

Basically, this surgical procedure improves your health and corrects any deformities or imperfections in your nose. Therefore, it has become a very frequent operation for people who suffer from these conditions.

Rhinoplasty and respiratory problems – does health insurance cover it?

It has already been mentioned that one of the reasons why many people decide to undergo rhinoplasty surgery is because of respiratory problems.

Although respiratory problems are caused by different factors, those that cause nasal obstruction permanently can harm our health.

When shortness of breath is caused by one of these problems, rhinoplasty is recommended:

Cysts or tumors in the nose:

Normally, this results in complications breathing through one side of the nose due to the obstruction that the malignant or benign tumor causes.

Atresia choanae:

It develops from birth and causes difficulty breathing when the bones close the nasopharynx, which means the back of the nose.

The condition is known as piriformis aperture stenosis (PAS).

This condition occurs when the nostril narrows in such a way that it causes obstruction of the nose.

Differing septums:

The septum leans more toward one side than the other, preventing normal breathing. An injury or birth defect can cause this problem.

A patient who has this type of problem should know if their medical insurance covers rhinoplasty. Read carefully if it is within the benefits of the policy you have or are planning to get. Why do we insist on this? Well, if your nose operation is purely cosmetic, you won’t be covered by insurance because cosmetic surgery isn’t covered by insurance.

Nevertheless, if your reason for your rhinoplasty operation is a congenital defect, an accident or illness, most medical insurance companies will cover the procedure.

The result is that many insurers include reconstructive plastic surgery within their policy, including rhinoplasty.

There are times when a doctor recommends that a patient with respiratory problems undergo a surgical intervention of this type in order to improve the person’s quality of life. As an example, if you suffer from sleep apnea, a breathing problem caused by the position of your nostrils, it would be wise to consult a doctor and confirm that the health insurance will cover a Rhinoplasty.

In unexpected cases such as accidents, where the nose is damaged and has to be rebuilt, you should know that the medical insurance covers a rhinoplasty.

Can anyone undergo rhinoplasty?

After learning the situations in which the medical insurance covers rhinoplasty, we will indicate which people can benefit from this type of surgery.

They must be in good health and psychologically prepared for the operation they are about to undergo.

Ideally, these surgeries should be performed on adolescents at a minimum age of 14 or 15 years in the case of girls, and 16 to 18 years in the case of boys. This is because the facial skeleton is at a mature stage.

What is the postoperative period like after a rhinoplasty?

Your health insurance might cover you for a rhinoplasty, but you should know that the recovery period lasts several days. First of all, the patient needs to prepare for the change once the splint is removed, especially since their facial features will change.

After the procedure, a nasal splint is usually placed which covers the affected part of the nose for greater protection. This splint should be worn for up to two weeks.

It is typical for the surrounding area to swell during the surgery, but over time it starts decreasing and by three or two months the final result is achieved.

Your nose will be proportionate and harmonious with your face. In addition, your respiratory problems will be solved and you will be able to breathe normally again.

also, read

how much does teeth whitening cost with insurance?