Out-of-pocket health care costs can be a major financial burden for many people. One way to reduce these costs is to choose a health insurance plan with a deductible. A deductible is the amount of money that you have to pay out of pocket before your insurance company starts paying for covered medical expenses.

There are a few things to consider when choosing a health insurance plan with a deductible. First, you need to think about your budget. If you have a tight budget, you may want to choose a plan with a higher deductible in order to lower your monthly premiums. However, keep in mind that you will have to pay more out of pocket if you need to file a claim.

Second, you need to consider your health and claims history. If you have a history of health problems or if you expect to need a lot of medical care, you may want to choose a plan with a lower deductible. This will help to reduce the amount of money you have to pay out of pocket if you need medical care.

Finally, you need to consider your risk tolerance. If you are comfortable with the risk of having to pay a higher deductible, then a plan with a higher deductible may be a good option for you. However, if you are not comfortable with the risk of having to pay a large amount of money out of pocket, then a plan with a lower deductible may be a better choice.

In the next section, we will discuss the different types of health insurance deductibles and how to choose the right one for you.

What is a health insurance deductible?

A health insurance deductible is the amount of money that you have to pay out of pocket before your insurance company starts paying for covered medical expenses. Deductibles are common to health insurance policies, and they can vary widely depending on the plan.

How does a health insurance deductible work?

When you have a health insurance policy with a deductible, you will have to pay for all of your covered medical expenses up to the amount of your deductible. Once you have met your deductible, your insurance company will start paying for your covered medical expenses, typically at a percentage of the cost.

Examples of how a health insurance deductible works

Let’s say you have a health insurance policy with a $1,000 deductible. You go to the doctor for a broken leg and your medical bills total $5,000. You will have to pay the first $1,000 of your medical bills out of pocket, and your insurance company will pay for the remaining $4,000.

Another example: Let’s say you have a health insurance policy with a $100 deductible. You go to the pharmacy and pick up a prescription for a new medication that costs $200. You will have to pay the first $100 out of pocket, and your insurance company will pay for the remaining $100.

Average health insurance deductible

The average cost in the United States has been steadily increasing in recent years. In 2023, the average health insurance deductible for a single person is $1,763, and the average health insurance deductible for a family is $2,543.

Types of health insurance deductibles

There are two main types of health insurance deductibles: fixed deductibles and percentage deductibles.

- Fixed deductibles: A fixed deductible is a set amount of money that you have to pay out of pocket before your insurance company starts paying for covered medical expenses. For example, you may have a $1,000 fixed deductible on your health insurance policy.

- Percentage deductibles: A percentage deductible is a percentage of the total cost of your covered medical expenses that you have to pay out of pocket before your insurance company starts paying. For example, you may have a 10% percentage deductible on your health insurance policy.

- High-deductible health plans (HDHPs): High-deductible health plans (HDHPs) are a type of health insurance plan that has a higher deductible than traditional health insurance plans. However, HDHPs also typically have lower monthly premiums.

How to choose the right health insurance deductible for you

When choosing a health insurance deductible, it is important to consider your budget, your health and claims history, and your risk tolerance.

- Consider your budget: If you are on a tight budget, you may want to choose a higher deductible health plan in order to lower your monthly premiums. However, keep in mind that you will have to pay more out of pocket if you need to file a claim.

- Consider your health and claims history: If you have a history of health problems or if you expect to need a lot of medical care, you may want to choose a lower deductible health plan. This will help to reduce the amount of money you have to pay out of pocket if you need medical care.

- Consider your risk tolerance: If you are comfortable with the risk of having to pay a higher deductible, then a high-deductible health plan may be a good option for you. However, if you are not comfortable with the risk of having to pay a large amount of money out of pocket, then a low-deductible plan may be a better choice.

Tips for managing your health insurance deductible

Here are a few tips for managing your health insurance deductible:

- Pay your deductible off in installments. Most insurance companies will allow you to pay your deductible off in installments over a period of time. This can help to make your deductible more affordable.

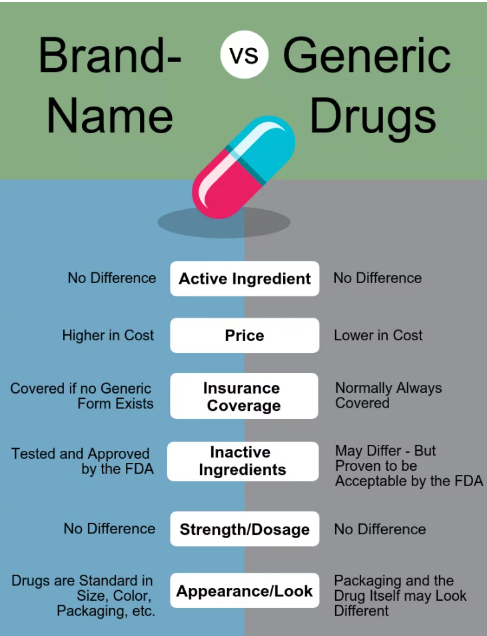

- Use generic drugs whenever possible. Generic drugs are just as safe and effective as name-brand drugs, but they typically cost much less. If you have a prescription for a name-brand drug, ask your doctor if there is a generic equivalent available.

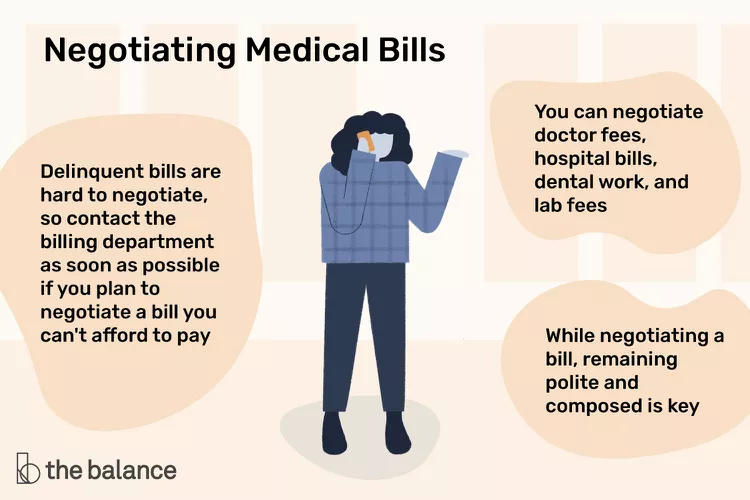

- Negotiate your medical bills. If you receive a medical bill that you can’t afford, contact the provider to see if they are willing to negotiate the bill. Many providers are willing to work with patients to set up payment plans or to reduce the amount of the bill.

Conclusion

A health insurance deductible is the amount of money that you have to pay out of pocket before your insurance company starts paying for covered medical expenses. Deductibles can vary widely depending on the plan, so it is important to choose a plan that has a deductible that you can afford.

There are a few things you can do to save more money, such as paying it off in installments, using generic drugs whenever possible, and negotiating your medical bills.

By following these tips, you can reduce the amount of money you have to pay out of pocket for your medical care.

FAQs

Q: What is the difference between a fixed deductible and a percentage deductible?

A: A fixed deductible is a set amount of money that you have to pay out of pocket before your insurance company starts paying for covered medical expenses. A percentage deductible is a percentage of the total cost of your covered medical expenses that you have to pay out of pocket before your insurance company starts paying.

Q: Why do some health insurance plans have deductibles and others don’t?

A: Deductibles are a way for insurance companies to share the cost of healthcare with their policyholders. By having a deductible, policyholders are more likely to think carefully about whether they really need medical care before they seek it. This can help to reduce the cost of healthcare for everyone.

Q: How can I save money on my health insurance deductible?

A: There are a few ways to save money. One way is to choose a higher deductible plan in order to lower your monthly premiums. Another way to save money on your deductible is to pay it off in installments. Most insurance companies will allow you to do this.

You can also save money on your deductible by using generic drugs whenever possible and by negotiating your medical bills.

Q: What should I do if I have a claim and I can’t afford to pay my deductible?

A: If you have a claim and you can’t afford to pay your deductible, you should contact your insurance company to see if there are any options available to you. Some insurance companies offer financial assistance to policyholders who are struggling to pay their deductibles.

You may also be able to qualify for government assistance programs that can help you to pay for your medical expenses.

I hope this article has helped you to understand what a health insurance deductible is and how it works. By following the tips above, you can manage your health insurance deductible and save money on your medical care.

We kindly invite you to check our insurance reviews page , and our health insurance blog .

We also recommend:

- how to find affordable health insurance

- How to file a health insurance claim

- Can You Have 3 Health Insurance Plans?

- How to choose the right health insurance plan for your family