Insurance for people with diabetes: What you need to know

Diabetes is a chronic health condition that affects millions of people worldwide. It is characterized by high blood sugar levels, which can lead to serious health complications over time. People with diabetes need access to quality healthcare to manage their condition and prevent complications. However, many people with diabetes face challenges in obtaining and maintaining affordable health insurance.

This article will provide you with an overview of insurance for people with diabetes. We will discuss the different types of health insurance plans available, how to choose the right plan for your needs, and tips for managing your insurance costs. We will also cover your rights under the Affordable Care Act and other resources available to help you get and keep health insurance.

Why is health insurance important for people with diabetes?

People with diabetes have a higher risk of developing serious health complications, such as heart disease, stroke, kidney failure, and blindness. Health insurance can help people with diabetes pay for the medical care they need to manage their condition and prevent complications.

What is diabetes?

Diabetes is a chronic health condition that affects how your body turns food into energy. There are two main types of diabetes: type 1 and type 2.

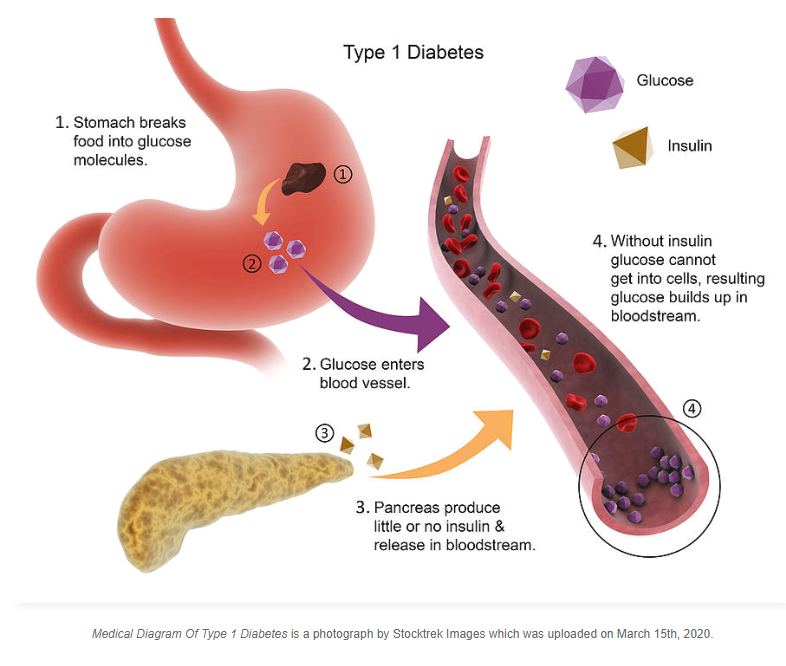

- Type 1 diabetes is an autoimmune disease that causes your body to attack the cells in your pancreas that produce insulin. Insulin is a hormone that helps your body use glucose (sugar) for energy.

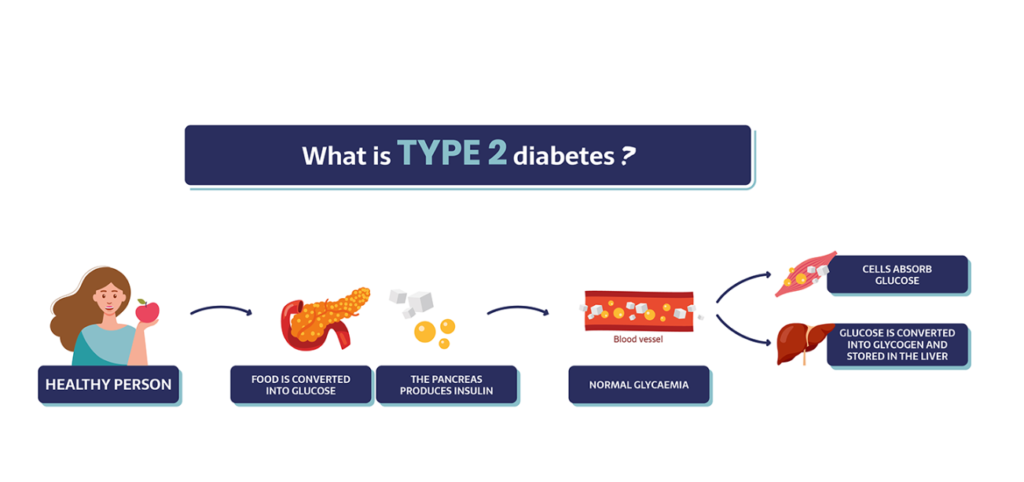

- Type 2 diabetes is the most common form of diabetes. It occurs when your body becomes resistant to insulin or doesn’t make enough insulin.

Diabetes disease diagram

Diabetes is a chronic health condition that affects how your body turns food into energy. There are two main types of diabetes: type 1 and type 2.

- Type 1 diabetes is an autoimmune disease that causes your body to attack the cells in your pancreas that produce insulin. Insulin is a hormone that helps your body use glucose (sugar) for energy.

- Type 2 diabetes is the most common form of diabetes. It occurs when your body becomes resistant to insulin or doesn’t make enough insulin.

Symptoms of diabetes

The symptoms of diabetes can vary depending on the type of diabetes you have and how severe it is. However, some common symptoms of diabetes include:

- Increased thirst

- Frequent urination

- Extreme hunger

- Unexplained weight loss

- Fatigue

- Blurred vision

- Slow-healing sores

- Numbness or tingling in the hands or feet

Complications of diabetes

Diabetes can lead to a number of serious health complications, including:

- Heart disease

- Stroke

- Kidney failure

- Blindness

- Nerve damage

- Amputation

- Pregnancy complications

Treatment for diabetes

There is no cure for diabetes, but there are treatments that can help you manage your blood sugar levels and reduce your risk of complications. Treatment for diabetes may include:

- Insulin therapy

- Oral medications

- Diet and exercise

- Weight loss

Prevention of diabetes

There is no surefire way to prevent diabetes, but there are things you can do to reduce your risk, such as:

- Maintaining a healthy weight

- Eating a healthy diet

- Exercising regularly

- Avoiding smoking

Why is it important for people with diabetes to have health insurance?

People with diabetes have a higher risk of developing serious health complications, such as heart disease, stroke, kidney failure, and blindness. Health insurance can help people with diabetes pay for the medical care they need to manage their condition and prevent complications.

What are the different types of health insurance plans available?

There are four main types of health insurance plans available in the United States:

- Employer-sponsored health insurance: This type of health insurance is offered by employers to their employees. It is the most common type of health insurance in the United States.

- Marketplace health insurance: Marketplace health insurance is available through the Health Insurance Marketplace, which is a government-run website. Individuals and families can purchase health insurance plans through the Marketplace.

- Medicaid: Medicaid is a government health insurance program for low-income individuals and families.

- Medicare: Medicare is a government health insurance program for people over the age of 65 and people with certain disabilities.

How to choose the right health insurance plan for you

When choosing a health insurance plan, it is important to consider your needs and budget. You should also compare different plans to find one that covers the services you need and has affordable premiums and copays.

Here are some tips for choosing a health insurance plan:

- Consider your needs and budget: Think about your health status, medications, and doctor visits. You should also consider your budget and how much you can afford to pay in premiums and copays.

- Compare different plans: Compare different health insurance plans to find one that covers the services you need and has affordable premiums and copays. You can compare plans on the Health Insurance Marketplace or through a private health insurance company.

- Read the fine print: Before you enroll in a health insurance plan, be sure to read the fine print. This includes the plan’s summary of benefits and coverage, as well as the plan’s exclusions and limitations.

Tips for managing your insurance costs if you have diabetes

Here are some tips for managing your insurance costs if you have diabetes:

- Take advantage of preventive care: Many health insurance plans cover preventive care services, such as annual checkups, screenings, and vaccinations. Preventive care can help you stay healthy and prevent complications, which can save you money in the long run.

- Use generic drugs whenever possible: Generic drugs are just as safe and effective as name-brand drugs, but they are typically much cheaper. Ask your doctor if generic drugs are available for your prescriptions.

- Negotiate your medical bills: If you receive a medical bill that you can’t afford, contact the provider to see if they are willing to negotiate the bill.

- Consider a high-deductible health plan: High-deductible health plans have lower premiums, but they have higher deductibles. This means that you will have to pay more out of pocket for medical expenses before your insurance coverage kicks in. However, high-deductible health plans can be a good option for people with diabetes who are healthy and who don’t expect to need much medical care.

- Take advantage of subsidies and tax credits: If you have a low or moderate income, you may be eligible for subsidies or tax credits to help you pay for health insurance premiums. You can learn more about subsidies and tax credits on the Health Insurance Marketplace website.

Conclusion

Having health insurance is essential for people with diabetes. Health insurance can help people with diabetes pay for the medical care they need to manage their condition and prevent complications. There are a number of different types of health insurance plans available, so it is important to compare plans and choose one that meets your needs and budget. There are also a number of tips that people with diabetes can follow to manage their insurance costs.

FAQs

Q: What is diabetes?

A: Diabetes is a chronic health condition that affects how your body turns food into energy. There are two main types of diabetes: type 1 and type 2.

Q: Why is it important for people with diabetes to have health insurance?

A: People with diabetes have a higher risk of developing serious health complications, such as heart disease, stroke, kidney failure, and blindness. Health insurance can help people with diabetes pay for the medical care they need to manage their condition and prevent complications.

Q: What are the different types of health insurance plans available?

A: There are four main types of health insurance plans available in the United States:

- Employer-sponsored health insurance: This type of health insurance is offered by employers to their employees. It is the most common type of health insurance in the United States.

- Marketplace health insurance: Marketplace health insurance is available through the Health Insurance Marketplace, which is a government-run website. Individuals and families can purchase health insurance plans through the Marketplace.

- Medicaid: Medicaid is a government health insurance program for low-income individuals and families.

- Medicare: Medicare is a government health insurance program for people over the age of 65 and people with certain disabilities.

Q: How do I choose the right health insurance plan for me?

A: When choosing a health insurance plan, it is important to consider your needs and budget. You should also compare different plans to find one that covers the services you need and has affordable premiums and copays.

Here are some tips for choosing a health insurance plan:

- Consider your needs and budget: Think about your health status, medications, and doctor visits. You should also consider your budget and how much you can afford to pay in premiums and copays.

- Compare different plans: Compare different health insurance plans to find one that covers the services you need and has affordable premiums and copays. You can compare plans on the Health Insurance Marketplace or through a private health insurance company.

- Read the fine print: Before you enroll in a health insurance plan, be sure to read the fine print. This includes the plan’s summary of benefits and coverage, as well as the plan’s exclusions and limitations.

Q: What are some tips for managing my insurance costs if I have diabetes?

A: Here are some tips for managing your insurance costs if you have diabetes:

- Take advantage of preventive care: Many health insurance plans cover preventive care services, such as annual checkups, screenings, and vaccinations. Preventive care can help you stay healthy and prevent complications, which can save you money in the long run.

- Use generic drugs whenever possible: Generic drugs are just as safe and effective as name-brand drugs, but they are typically much cheaper. Ask your doctor if generic drugs are available for your prescriptions.

- Negotiate your medical bills: If you receive a medical bill that you can’t afford, contact the provider to see if they are willing to negotiate the bill.

- Consider a high-deductible health plan: High-deductible health plans have lower premiums, but they have higher deductibles. This means that you will have to pay more out of pocket for medical expenses before your insurance coverage kicks in. However, high-deductible health plans can be a good option for people with diabetes who are healthy and who don’t expect to need much medical care.

- Take advantage of subsidies and tax credits: If you have a low or moderate income, you may be eligible for subsidies or tax credits to help you pay for health insurance premiums.

Q: What are some other tips for people with diabetes who are looking for health insurance?

A: Here are some other tips for people with diabetes who are looking for health insurance:

- Talk to your doctor: Your doctor can help you understand your health insurance options and choose a plan that is right for you.

- Get help from a health insurance broker: A health insurance broker can help you compare plans and choose the best plan for your needs.

- Use the Health Insurance Marketplace: The Health Insurance Marketplace is a government-run website that makes it easy to compare health insurance plans and enroll in a plan.

- Be aware of your rights: People with diabetes have certain rights under the Affordable Care Act. For example, you cannot be denied coverage or charged higher premiums because of your diabetes.

Conclusion

Having health insurance is essential for people with diabetes. Health insurance can help people with diabetes pay for the medical care they need to manage their condition and prevent complications. There are a number of different types of health insurance plans available, so it is important to compare plans and choose one that meets your needs and budget. There are also a number of tips that people with diabetes can follow to manage their insurance costs.

Additional tips:

- Shop around and compare plans: Compare different health insurance plans to find one that covers the services you need and has affordable premiums and copays. You can compare plans on the Health Insurance Marketplace or through a private health insurance company.

- Consider a health savings account (HSA): An HSA is a tax-advantaged savings account that can be used to pay for qualified medical expenses. This can be a good option for people with diabetes who have high medical expenses.

- Work with your doctor to manage your diabetes: By working with your doctor to manage your diabetes, you can help to reduce your risk of complications and save money on your health care costs.

If you have diabetes and are looking for health insurance, there are a number of resources available to help you. Talk to your doctor, get help from a health insurance broker, or use the Health Insurance Marketplace to compare plans and find the best plan for your needs.

be sure to check our category: insurance for people with pre-existing conditions

Remember to check our homepage , and our awesome blog posts about different insurance-related topics and insurance company’s reviews. for example insurance for people with pre-existing conditions

Related topics:

- How to find affordable life insurance if you have a chronic health condition

- How to get business insurance if you have a high-risk job

- Types of insurance available for people with pre-existing conditions

- what companies are in the consumer durables field

- what insurance company covers mounjaro

- How to get approved for insurance if you have a pre-existing condition

- Tips for managing your insurance costs if you have a pre-existing condition